US Federal Bill Would Eliminate Sportsbooks' Handle Tax

A new initiative that could potentially reshape the financial landscape of sports betting in the U.S. has emerged. Senators Catherine Cortez Masto of Nevada and Cindy Hyde-Smith of Massachusetts have introduced a bill poised to eliminate the federal handle tax imposed on sportsbooks.

The proposed legislation, the WAGER Act (Withdrawing Arduous Gaming Excise Rates), aims to relieve sportsbooks from the burden of a tax on each bet placed and an annual head tax on every sportsbook employee. This legislative effort reflects a growing recognition of the sports betting industry's economic impact and the need to foster a more conducive environment for its growth.

Related: Increasing Support for Upping Tax Threshold on Slot WinningsThe WAGER Act mirrors a bipartisan effort previously seen in the House, where Representatives Dina Titus of Nevada and Guy Reschenthaler of Pennsylvania introduced similar legislation in March 2023. The alignment between the Senate and House initiatives underscores a shared vision for the future of sports betting in America. By proposing to exempt legal sportsbooks from the 0.25% handle tax per wager and the $50 annual fee per employee, the bill advocates for a more sustainable operational model for sports betting entities.

After the new bill was presented, Titus expressed optimism about repealing the handle tax, now that there is legislation in both houses. She emphasized that the tax unfairly targets lawful gaming operators and penalizes sportsbooks that generate employment.

Titus described the tax as outdated and counterproductive, inhibiting the development of legal sportsbooks in Nevada and beyond. She also mentioned that even the IRS struggles to clearly account for the revenue generated from this tax.

More Business News

Tax Burden Stifling Growth

Supporters of the WAGER Act argue that the current tax structure is an onerous burden that stifles competition and innovation within the industry. They contend that the removal of these taxes would lead to increased investment, job creation, and a more robust market that could generate significant tax revenues through growth rather than through punitive measures.

Critics, however, raise concerns about the potential for increased gambling addiction and the societal costs associated with it. They're calling for a balanced approach that considers the welfare of the broader community.

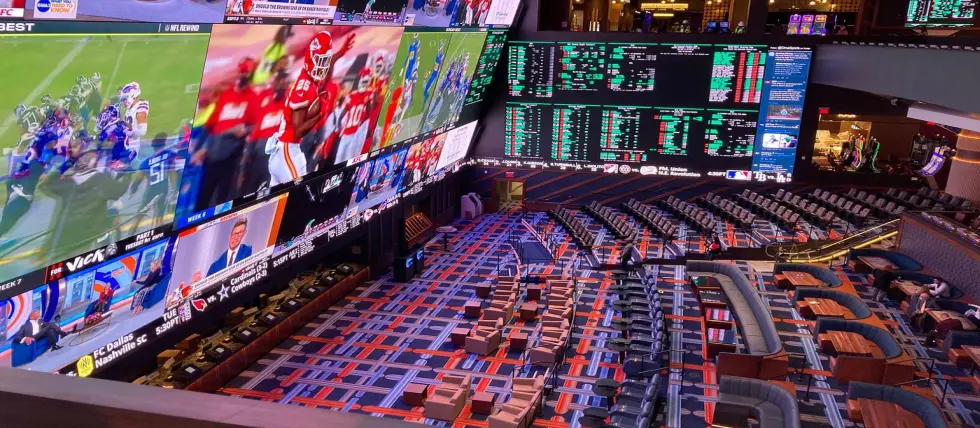

The introduction of the WAGER Act comes at a time when sports betting is experiencing unprecedented growth in the U.S. Following the Supreme Court's 2018 decision to overturn the Professional and Amateur Sports Protection Act (PASPA), states have been rapidly legalizing and regulating sports betting, leading to a burgeoning market. The WAGER Act's proponents believe that the elimination of the federal handle tax would further accelerate this growth, positioning the U.S. as a global leader in the sports betting industry.

As the WAGER Act makes its way through the legislative process, its potential impact on the sports betting landscape remains a topic of considerable debate. Stakeholders from various sectors, including gaming operators, regulatory bodies, and consumer protection groups, are closely monitoring the bill's progress. The outcome of this legislative endeavor will undoubtedly have far-reaching implications for the sports betting industry, the economy, and the regulatory framework governing gambling in the U.S.

RELATED TOPICS: Business

Most Read

Must Read

Interviews

Interviews

Sweepstakes Casinos: Thriving in an Ever-Changing Industry – Interview with Attorney Stephen C. Piepgrass

Feb 17, 2025 Interviews

Interviews

Review this New Post

Leave a Comment

User Comments

Comments for US Federal Bill Would Eliminate Sportsbooks' Handle Tax