Commercial Gaming Industry Surges with $5.49 Billion in Revenue

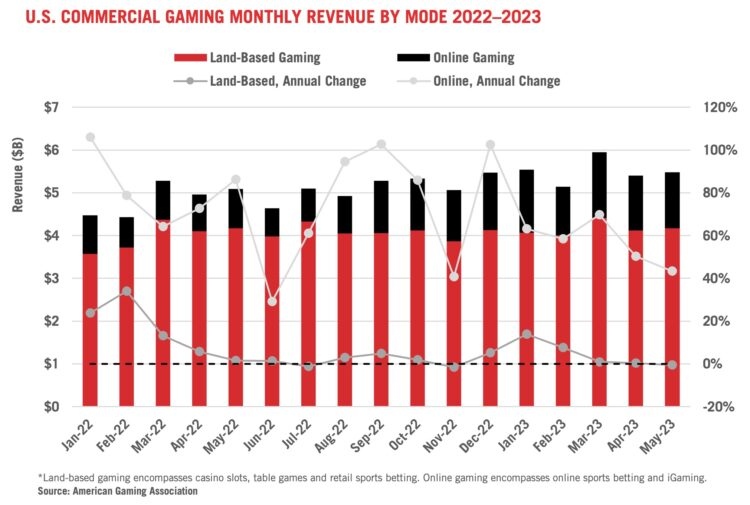

The U.S. commercial gaming industry continued its upward trajectory in May 2023, with revenues reaching a staggering $5.49 billion, representing a growth of over six percent compared to the previous year.

These encouraging figures were revealed in the latest edition of the AGA's Commercial Gaming Revenue Tracker, which provides comprehensive insights into the financial performance of the industry across states.

This achievement marked the 27th consecutive month of annual national growth, showcasing the resilience and strength of the commercial gaming sector. However, the report also highlighted an interesting development: the performance of state markets began to diverge as the comparisons were no longer influenced by past COVID-19 concerns.

Increase in First Half of 2023

Throughout the first five months of 2023, the commercial gaming industry showed no signs of slowing down, tracking an impressive 12.4 percent ahead of the record-setting pace of the previous year. The cumulative revenue amassed through May reached a remarkable $27.59 billion.

Despite the healthy annual growth rate in May, the pace of revenue acceleration has slightly decelerated for the fourth consecutive month. This can be attributed to the end of COVID-19-related impacts on year-over-year growth measures.

One of the notable trends revealed in the report was the increasing dominance of online gaming in fueling the industry's growth. While gaming at brick-and-mortar casinos revenue witnessed a slight contraction in May (-0.6%), the overall growth was significantly driven by online gaming, which experienced a remarkable 43.4 percent year-over-year increase.

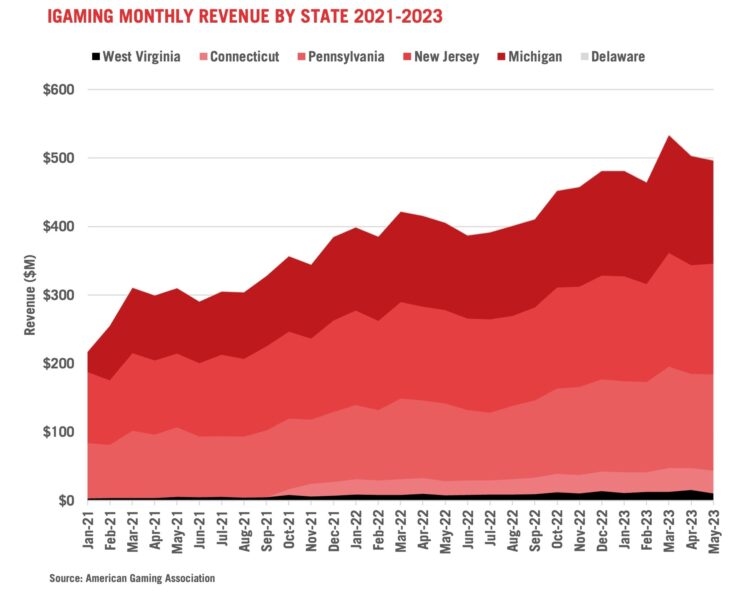

This growth was largely attributed to the introduction of online sports betting in Kansas, Maryland, Massachusetts, and Ohio within the past year, as well as the continued expansion of the iGaming industry in states where it is already legal.

More Growth in Sectors Unveiled

At the state level, most commercial gaming jurisdictions reported annual revenue gains in May, with 24 out of 33 operational states posting positive results. On the other hand, nine states, including Delaware, Florida, Iowa, Indiana, Louisiana, Missouri, Nevada, and Oregon, experienced declines in overall revenue.

The slowdown in the traditional casino segment and lower sports betting revenue were cited as the primary reasons for the dip in these states.

However, traditional casino slot machines and table games remained the backbone of the industry's revenue, though their growth has somewhat slowed compared to digital offerings. In May, these segments generated total revenue of $4.12 billion, with slot machines contributing $2.98 billion (up 1.3 percent) and table games contributing $834.3 million (down 4.8 percent).

Sports betting and iGaming continued their impressive expansion, both reporting the highest May revenue levels ever recorded. Commercial revenue from sports betting, both land-based and online, reached $864.1 million across 28 jurisdictions. This marked a remarkable increase of 41.5 percent from May 2022 when commercial sports betting markets were active in 26 jurisdictions.

Furthermore, the combined revenue from iGaming operations in six states—Connecticut, Delaware, Michigan, New Jersey, Pennsylvania, and West Virginia—experienced a significant year-over-year increase of 22.4 percent in May, reaching $497.4 million.

The U.S. commercial gaming industry's consistent growth and diversification through online offerings are expected to continue driving revenue to new heights. With more states embracing online gaming and sports betting, the industry's upward trajectory appears set to remain for the foreseeable future.

More Finance News

RELATED TOPICS: Finance

Most Read

Must Read

Interviews

Interviews

Sweepstakes Casinos: Thriving in an Ever-Changing Industry – Interview with Attorney Stephen C. Piepgrass

Feb 17, 2025 Interviews

Interviews

Review this New Post

Leave a Comment

User Comments

Comments for Commercial Gaming Industry Surges with $5.49 Billion in Revenue and 6% Growth