Bally's Corporation Reports Strong Financial Performance in Q4

Bally's Corporation reported its financial highlights for the fourth quarter and full year of 2022. The company generated revenue of $576.7 million and $2.3 billion for the respective periods. The net loss for the fourth quarter was $487.5 million, and $425.5 million for the full year, which included non-cash goodwill and asset impairment charges of $464.0 million.

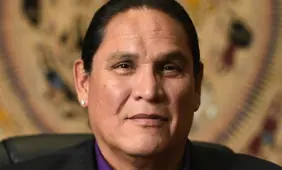

Bally's CEO, Lee Fenton, will step down, and Robeson Reeves will take over as CEO, effective March 31, 2023. The company's adjusted EBITDA for the fourth quarter and full year were $145.8 million and $548.5 million, respectively, and adjusted EBITDAR were $164.4 million and $601.8 million, respectively. Bally's soon-to-be new CEO, Robeson Reeves, stated that the company achieved record results in both its Casinos & Resorts and International Interactive segments, generating fantastic cash flows.

The company's core businesses are expanding in the UK and Asia, with positive organic growth in the iCasino states of New Jersey and Ontario. Bally's President - Casinos & Resorts, George Papanier, stated that the company saw continued momentum across the portfolio during the fourth quarter, and it broke ground on its temporary facility in Chicago, expected to contribute to the business in the second half of 2023.

The company is focusing on generating cash flows to invest in long-term growth opportunities for the entire Bally's portfolio, decreasing significant capital expenditures toward property improvements in 2023. The company's 2023 guidance estimates revenue in the range of $2.5 billion to $2.6 billion and adjusted EBITDAR in the range of $660 million to $700 million.

Bally's repurchased 0.9 million shares of its common stock for an aggregate purchase price of $20.8 million during the fourth quarter, and it currently has $190.4 million available for use under its capital return program, subject to limitations in its regulatory and debt agreements.

On January 3, 2023, Bally's completed its previously announced sale-leaseback transaction with GLPI for the land and real estate assets of Bally's Tiverton and Hard Rock Biloxi for total net proceeds of $609.1 million, and it recorded a non-cash impairment charge of $390.7 million in the North America Interactive segment and $73.3 million in the International Interactive segment.

More Finance News

RELATED TOPICS: Finance

Most Read

Must Read

Interviews

Interviews

Sweepstakes Casinos: Thriving in an Ever-Changing Industry – Interview with Attorney Stephen C. Piepgrass

Feb 17, 2025 Interviews

Interviews

Review this New Post

Leave a Comment

User Comments

Comments for Bally's Corporation Reports Strong Financial Performance in Q4